The State of Cryptocurrency in 2025

Cryptocurrency has matured significantly since its inception, and by 2025, the landscape is more vibrant and intricate than ever. The global market capitalization of cryptocurrencies has grown, surpassing key milestones as both institutional and retail adoption increase. Blockchain technology continues to expand beyond finance, finding applications in supply chain management, healthcare, gaming, and more.

One notable trend in 2025 is the rise of central bank digital currencies (CBDCs). Countries worldwide are exploring or implementing their own digital currencies, signaling a shift toward blockchain-based monetary systems. Meanwhile, traditional cryptocurrencies like Bitcoin and Ethereum maintain their dominance, with Bitcoin solidifying its reputation as a “digital gold” and Ethereum continuing to lead in decentralized applications (dApps).

Moreover, advancements in layer-2 solutions and interoperability protocols have addressed many scalability concerns, making crypto transactions faster and cheaper. These developments, along with improved user experiences and security, have bolstered confidence in the market.

Market Size Growth of Cryptocurrency

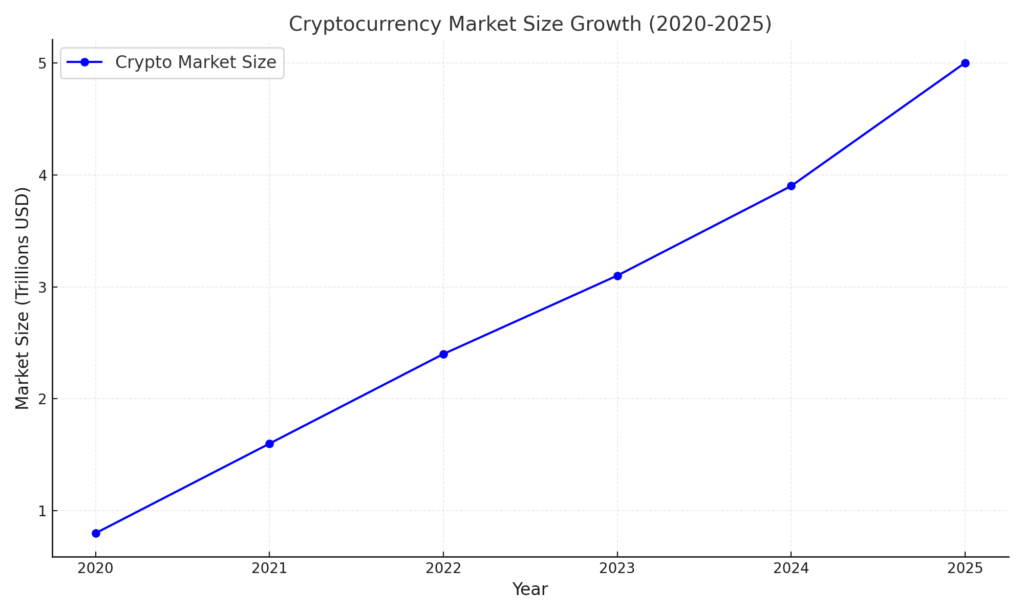

The cryptocurrency market has witnessed impressive growth in recent years. Below is a graph depicting the hypothetical growth of the global cryptocurrency market size from 2020 to 2025:

As shown, the market size has grown from $0.8 trillion in 2020 to a projected $5.0 trillion by 2025, highlighting the immense potential and increasing adoption of digital assets.

Advantages of Investing in Cryptocurrency

1. High Growth Potential

Cryptocurrencies have demonstrated exponential growth over the years. Even in a volatile market, many assets have provided returns that outperform traditional investments. Bitcoin, for instance, reached record highs in previous years, and newer projects like Solana and Polygon are showing promise in innovation and scalability.

2. Decentralization and Security

Blockchain technology ensures that cryptocurrencies operate on decentralized networks, removing the need for intermediaries like banks. This decentralization provides a level of transparency and security unmatched by traditional financial systems.

3. Diverse Investment Opportunities

The crypto market offers a range of investment options beyond just coins and tokens. From staking and yield farming in DeFi platforms to investing in NFTs and blockchain-based startups, the possibilities are vast. These options allow investors to diversify their portfolios within the crypto ecosystem.

4. Inflation Hedge

Cryptocurrencies like Bitcoin have a capped supply, making them resistant to inflationary pressures. As fiat currencies lose value over time due to inflation, Bitcoin and other limited-supply cryptos are increasingly viewed as reliable stores of value.

Challenges and Risks in 2025

1. Market Volatility

Cryptocurrency prices remain highly volatile, with sharp fluctuations that can result in significant gains or losses within short periods. For instance, Bitcoin’s price swings can still deter risk-averse investors.

2. Regulatory Uncertainty

Governments worldwide are grappling with how to regulate cryptocurrencies. While some have embraced them, others impose restrictions or outright bans, creating uncertainty for investors. For instance, new tax laws or compliance requirements in major economies could impact market behavior.

3. Environmental Concerns

The environmental impact of cryptocurrency mining, particularly for Proof of Work (PoW) coins like Bitcoin, remains a contentious issue. However, solutions like Ethereum’s transition to Proof of Stake (PoS) and the emergence of eco-friendly blockchains are mitigating these concerns.

4. Security Risks

Despite advancements, the crypto market is still susceptible to hacking, phishing attacks, and scams. High-profile breaches and rug pulls have caused substantial losses for investors.

Factors to Consider Before Investing

1. Understanding the Technology

Before investing, it’s crucial to understand the basics of blockchain technology and the specific cryptocurrencies you’re interested in. Resources like whitepapers, community forums, and expert analyses can provide valuable insights.

2. Portfolio Diversification

While crypto can offer high returns, it’s essential to diversify your investments. Consider allocating a portion of your portfolio to traditional assets like stocks, bonds, or real estate to balance risk.

3. Risk Tolerance

Assess your financial goals and ability to withstand potential losses. Cryptocurrency investing isn’t suitable for everyone, particularly those with a low risk tolerance.

4. Market Trends and Analysis

Stay updated on market trends, news, and technical analyses. Tools like TradingView and CoinMarketCap can help you monitor price movements and sentiment.

Case Studies and Expert Opinions

1. Success Stories

Several early adopters of Bitcoin and Ethereum have seen life-changing returns. For instance, Bitcoin’s meteoric rise from a few dollars to tens of thousands per coin is a testament to its growth potential.

2. Expert Insights

Financial experts and crypto analysts highlight the importance of a long-term perspective. According to industry leaders, diversification within the crypto space and investing in projects with strong fundamentals are key strategies for success in 2025.

3. Promising Cryptocurrencies

Projects like Ethereum, Solana, and Cardano continue to innovate, making them attractive options for investors seeking long-term growth potential.

Alternatives to Cryptocurrency Investment

If the volatility of crypto is a concern, consider traditional investment avenues such as:

- Stocks and ETFs: Companies like Coinbase and Nvidia offer indirect exposure to the crypto industry.

- Real Estate: A tangible asset class that provides steady income and value appreciation.

- Precious Metals: Gold and silver remain reliable stores of value.

Conclusion

Cryptocurrency in 2025 presents a mix of opportunities and challenges. While the market has matured and adoption continues to grow, risks like volatility and regulatory uncertainty remain significant factors to consider. For investors willing to navigate these complexities, crypto can still offer high rewards, especially with a diversified and informed approach.

Whether you’re an experienced trader or a curious newcomer, staying educated and cautious is key. Keep researching, follow market trends, and evaluate your financial goals before making decisions. Cryptocurrency may not guarantee overnight success, but for those who invest wisely, it remains a promising frontier in the world of finance.