The Union Budget 2025-26 has introduced revised income tax slabs, bringing relief to many taxpayers while maintaining a balance between fiscal discipline and economic growth. With adjusted tax rates and an increased exemption limit, individuals and businesses must carefully evaluate their tax planning strategies.

In this article, we will cover:

✅ New income tax slabs for FY 2025-26

✅ Comparison between the Old and New Tax Regimes

✅ Tax exemptions and deductions available

✅ Tax planning strategies to optimize savings

Let’s start by understanding how income tax slabs work and what has changed in Budget 2025-26.

Understanding Income Tax Slabs in India

What Are Income Tax Slabs?

Income tax in India follows a progressive taxation system, meaning that as income increases, the tax rate also increases. This is structured into different income slabs, with each slab being taxed at a specific rate.

Why Are Tax Slabs Updated?

The government revises tax slabs periodically to:

✔ Adjust for inflation.

✔ Provide relief to taxpayers.

✔ Ensure fair tax distribution across different income groups.

Let’s now explore the latest income tax slabs for FY 2025-26.

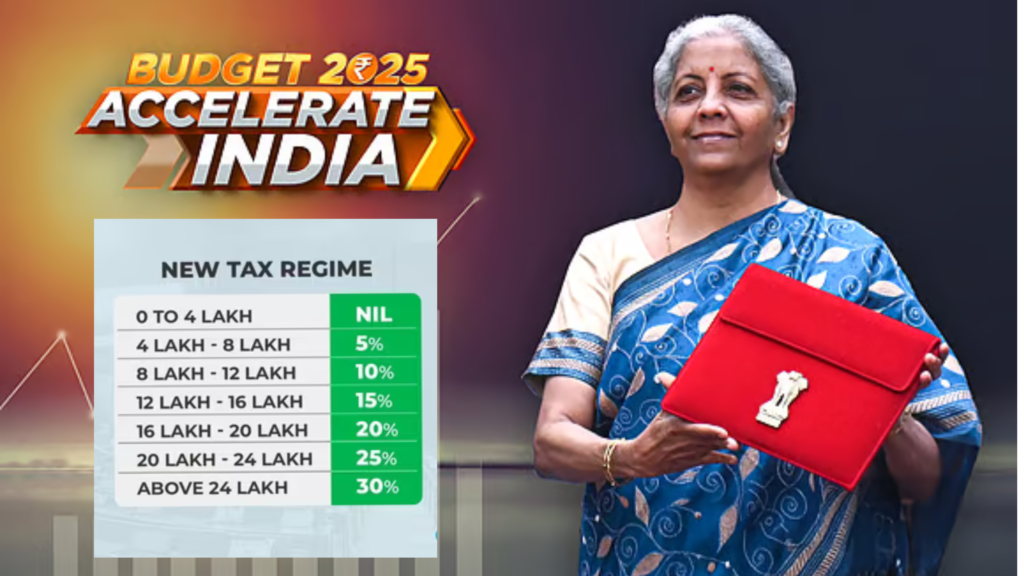

Income Tax Slabs for FY 2025-26 (New Regime)

The new tax regime continues to provide simplified tax slabs with lower rates but fewer exemptions. Here are the revised tax slabs for FY 2025-26:

Table 1: Latest Income Tax Slabs for FY 2025-26 (New Regime)

| Income Range | Tax Rate |

|---|---|

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Key Changes in 2025-26:

✔ Exemption limit increased from ₹2.5 lakh to ₹4 lakh.

✔ Lower tax rates for middle-income groups.

✔ More taxpayers can now benefit from reduced tax rates under the new regime.

In the next section, let’s compare the Old vs. New tax regime to help taxpayers choose the best option.

Income Tax Slabs for FY 2025-26 (Old vs. New Regime)

One of the biggest dilemmas for taxpayers is whether to choose the old tax regime or the new tax regime. Both have their own advantages depending on an individual’s income, exemptions, and tax-saving investments.

Old vs. New Regime: Key Differences

| Feature | Old Regime | New Regime |

|---|---|---|

| Basic Exemption Limit | ₹2.5 lakh | ₹4 lakh |

| Standard Deduction | ₹50,000 | ₹50,000 |

| Section 80C (Deductions on Investments) | Available (₹1.5 lakh) | Not Available |

| House Rent Allowance (HRA), LTA | Available | Not Available |

| Home Loan Interest Deduction (Sec 24b) | ₹2 lakh | Not Available |

| Best For | Those with multiple exemptions & deductions | Salaried taxpayers without many deductions |

Old vs. New Regime Tax Slabs for 2025-26

| Income Range | Old Regime Tax Rate | New Regime Tax Rate (2025-26) |

|---|---|---|

| ₹0 – ₹2.5 Lakh | Exempt | Exempt |

| ₹2.5 L – ₹4 L | 5% | Exempt |

| ₹4 L – ₹8 L | 5% | 5% |

| ₹8 L – ₹12 L | 20% | 10% |

| ₹12 L – ₹16 L | 20% | 15% |

| ₹16 L – ₹20 L | 30% | 20% |

| ₹20 L – ₹24 L | 30% | 25% |

| Above ₹24 L | 30% | 30% |

Which Tax Regime Should You Choose?

✅ Choose the New Regime if:

✔ You prefer simpler tax slabs with lower rates.

✔ You don’t claim many deductions like HRA, 80C, or home loan interest.

✔ Your annual taxable income is ₹10-15 lakh, as the new regime offers better savings.

✅ Stick to the Old Regime if:

✔ You have high deductions (PPF, ELSS, NPS, Home Loan, etc.).

✔ You receive HRA, LTA, and other exemptions from your employer.

✔ Your annual taxable income is above ₹15 lakh and deductions help lower your tax liability.

Example Calculation: Old vs. New Regime

Case 1: Salaried Individual (Income ₹15,00,000)

| Particulars | Old Regime (₹) | New Regime (₹) |

|---|---|---|

| Gross Salary | 15,00,000 | 15,00,000 |

| Standard Deduction | (-) 50,000 | (-) 50,000 |

| 80C Deductions (PPF, EPF, LIC) | (-) 1,50,000 | Not Applicable |

| 80D (Health Insurance) | (-) 25,000 | Not Applicable |

| Home Loan Interest Deduction | (-) 2,00,000 | Not Applicable |

| Taxable Income | ₹11,75,000 | ₹14,50,000 |

| Tax Payable | ₹1,92,500 | ₹1,75,000 |

Conclusion: The old regime is better in this case, as deductions reduce taxable income.

Case 2: Salaried Individual (Income ₹10,00,000) Without Deductions

| Particulars | Old Regime (₹) | New Regime (₹) |

|---|---|---|

| Gross Salary | 10,00,000 | 10,00,000 |

| Standard Deduction | (-) 50,000 | (-) 50,000 |

| 80C Deductions | Not Applicable | Not Applicable |

| Taxable Income | ₹9,50,000 | ₹9,50,000 |

| Tax Payable | ₹1,12,500 | ₹87,500 |

Conclusion: The new regime is better in this case, as the tax rates are lower.

Key Takeaway:

✔ If you claim high deductions, the old regime is beneficial.

✔ If you don’t have many deductions, the new regime offers tax savings.

Tax Exemptions & Deductions in 2025-26

One of the biggest differences between the old and new tax regimes is the availability of tax exemptions and deductions. The old regime allows various deductions that help reduce taxable income, while the new regime offers lower tax rates but removes most exemptions.

Let’s explore the key deductions and exemptions available for taxpayers in FY 2025-26 under both regimes.

Tax Deductions Available Under the Old Regime

If you choose the old tax regime, you can claim various deductions under different sections of the Income Tax Act. Below are some of the most commonly used deductions:

| Section | Deduction Type | Maximum Limit |

|---|---|---|

| Section 80C | Investments in PPF, EPF, LIC, ELSS, NPS, etc. | ₹1,50,000 |

| Section 80D | Health Insurance Premiums | ₹25,000 (₹50,000 for seniors) |

| Section 24(b) | Home Loan Interest | ₹2,00,000 |

| Section 80E | Education Loan Interest | No Limit |

| Section 80G | Donations to Charitable Institutions | 50-100% of donation |

| HRA Exemption | House Rent Allowance | Based on Salary & Rent Paid |

| LTA Exemption | Leave Travel Allowance | Travel Fare (Twice in 4 Years) |

Tax Deductions & Exemptions Under the New Regime

The new tax regime is designed to be simple and does not allow most exemptions or deductions. However, Budget 2025-26 has retained some key benefits:

✅ Standard Deduction of ₹50,000 is still available.

✅ Employer’s contribution to NPS (Sec 80CCD(2)) is allowed.

✅ Deduction for Agniveer Corpus Fund (new benefit introduced).

Comparison of Tax Deductions: Old vs. New Regime

| Deduction Type | Old Regime | New Regime |

|---|---|---|

| Standard Deduction (₹50,000) | ✅ Allowed | ✅ Allowed |

| Section 80C (Investments) | ✅ Allowed | ❌ Not Allowed |

| Section 80D (Health Insurance) | ✅ Allowed | ❌ Not Allowed |

| Home Loan Interest (Section 24b) | ✅ Allowed | ❌ Not Allowed |

| HRA & LTA Exemptions | ✅ Allowed | ❌ Not Allowed |

| Employer NPS Contribution | ✅ Allowed | ✅ Allowed |

Who Benefits More from Deductions?

✅ If you invest heavily in 80C options (PPF, LIC, ELSS) or have a home loan, the old regime is better.

✅ If you don’t have major tax-saving investments, the new regime’s lower tax rates are more beneficial.

Case Study: Tax Savings with Deductions

Let’s compare two taxpayers, one opting for the old regime with deductions and another choosing the new regime with no deductions.

Case 1: Taxpayer with ₹12,00,000 Income

| Particulars | Old Regime (₹) | New Regime (₹) |

|---|---|---|

| Gross Income | 12,00,000 | 12,00,000 |

| Standard Deduction | (-) 50,000 | (-) 50,000 |

| 80C (LIC, ELSS, PPF) | (-) 1,50,000 | Not Applicable |

| 80D (Health Insurance) | (-) 25,000 | Not Applicable |

| Home Loan Interest Deduction | (-) 2,00,000 | Not Applicable |

| Taxable Income | ₹8,75,000 | ₹11,50,000 |

| Tax Payable | ₹87,500 | ₹1,15,000 |

Key Takeaway:

✔ In this case, the old regime saves ₹27,500 because of deductions.

✔ However, if the taxpayer doesn’t claim deductions, the new regime is more tax-efficient.

Tax Planning Strategies for 2025-26

Effective tax planning is essential for minimizing tax liability while ensuring maximum savings. Whether you opt for the old regime with deductions or the new regime with lower rates, the right tax-saving strategy can help you retain more of your income.

Here are the best tax-saving strategies for FY 2025-26 based on your income and tax regime preference.

Tax Planning for Individuals Choosing the Old Regime

If you prefer the old tax regime, follow these strategies to make the most of available deductions:

✅ Maximize 80C Deductions – Invest ₹1.5 lakh in:

✔ Public Provident Fund (PPF) – Safe, long-term investment with tax-free returns.

✔ Employees’ Provident Fund (EPF) – Employer contributes, helping retirement savings.

✔ National Pension System (NPS) – Additional tax deduction under Section 80CCD(1B).

✔ Equity-Linked Savings Scheme (ELSS) – Mutual funds with tax-saving benefits.

✅ Use 80D for Health Insurance

✔ Claim ₹25,000 deduction for self & family health insurance.

✔ If parents (aged above 60) are covered, claim ₹50,000 additional deduction.

✅ Claim HRA & LTA Benefits

✔ If living in a rented house, use House Rent Allowance (HRA) exemption.

✔ Utilize Leave Travel Allowance (LTA) for domestic travel tax benefits.

✅ Claim Home Loan Interest Deduction (Sec 24b)

✔ Get ₹2 lakh deduction on interest paid for a self-occupied house.

✔ Use additional deduction if it’s a first-time home purchase.

✅ Utilize Education Loan Benefits

✔ 80E deduction allows you to claim unlimited tax exemption on interest paid for an education loan.

✅ Save Tax on Donations (Sec 80G)

✔ Donate to eligible charities or PM CARES Fund to claim 50%-100% deduction.

Tax Planning for Individuals Choosing the New Regime

If you prefer the new regime, the focus shifts from tax deductions to effective salary structuring and direct tax-saving investments:

✅ Use Standard Deduction of ₹50,000

✔ Available for both salaried and pensioners.

✅ Optimize Your Salary Structure

✔ Ask your employer to increase NPS contributions, as it remains tax-free.

✔ Request a higher food allowance or travel reimbursement, as they are still tax-exempt.

✅ Invest in Tax-Free Instruments

✔ Public Provident Fund (PPF) still offers tax-free interest (though not deductible).

✔ Voluntary Provident Fund (VPF) – Employer’s contributions are tax-free under Sec 80CCD(2).

✅ Capitalize on Lower Tax Slabs

✔ Since tax rates are lower in the new regime, focus on increasing take-home salary rather than tax-saving deductions.

✅ Use Agniveer Corpus Fund Deduction

✔ A new tax-free savings scheme introduced for specific beneficiaries.

Best Tax-Saving Strategy Based on Income Level

| Annual Income | Recommended Tax Regime | Key Strategy |

|---|---|---|

| ₹5 lakh – ₹10 lakh | New Regime | Lower tax rates = more savings. |

| ₹10 lakh – ₹15 lakh | Compare Both | Old regime if claiming ₹2.5L+ deductions. |

| ₹15 lakh – ₹25 lakh | Old Regime | Maximize 80C, 80D, and HRA benefits. |

| Above ₹25 lakh | New Regime | Focus on salary structuring & tax-free investments. |

Final Tax Planning Tips for 2025-26

✅ File your ITR before the due date to avoid penalties.

✅ Use tax-saving FDs (5-year lock-in) if you want safe investment options.

✅ Avoid last-minute tax planning – start investing early in the financial year.

✅ Check for new government incentives for first-time homebuyers or senior citizens.

✅ Compare both regimes every year before filing your taxes.

Conclusion & Key Takeaways

As the Budget 2025-26 introduces new tax slabs, it’s important to understand how the changes impact your tax liability. Choosing between the old regime and new regime depends on your income level, tax-saving investments, and financial goals.

📌 Key Takeaways

✅ New Regime Has Higher Exemption Limits – The basic exemption limit is now ₹4 lakh instead of ₹2.5 lakh.

✅ Lower Tax Rates in the New Regime – Taxpayers earning up to ₹24 lakh may pay less tax in the new regime.

✅ Old Regime Still Benefits Those with Deductions – If you claim deductions like 80C (₹1.5 lakh), 80D (₹25,000), and home loan interest (₹2 lakh), the old regime is a better option.

✅ Compare Both Regimes Before Filing ITR – Use a tax calculator to check which regime helps you save more.

✅ Early Tax Planning Helps Maximize Savings – Start investing at the beginning of the financial year to utilize deductions effectively.

💡 Actionable Next Steps

✔ Check your current tax deductions – List down your investments, HRA, home loan, and health insurance benefits.

✔ Use an online tax calculator to compare the old vs. new regime.

✔ If choosing the old regime, start investing in PPF, NPS, ELSS, or FDs for maximum savings.

✔ If opting for the new regime, focus on optimizing salary structure & employer benefits.

✔ File your ITR before the deadline to avoid penalties and last-minute stress.

📢 Final Thought: Which Tax Regime is Right for You?

👉 Choose the New Regime if you prefer lower tax rates and don’t claim deductions.

👉 Choose the Old Regime if you have high deductions and want to maximize tax savings.

Every taxpayer’s situation is different. Compare, calculate, and choose wisely! ✅

Frequently Asked Questions (FAQs) on Income Tax Slabs 2025-26

Here are some of the most common questions taxpayers have about the new tax regime, old tax regime, deductions, and filing process in FY 2025-26.

General FAQs on Income Tax Slabs

🔹 Q1. What are the income tax slabs for FY 2025-26 (AY 2026-27)?

✔ The revised tax slabs for 2025-26 under the new regime are:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

🔹 Q2. What is the difference between the new tax regime and the old tax regime?

✔ The new regime offers lower tax rates but no deductions, while the old regime allows tax-saving deductions like 80C, 80D, and HRA.

🔹 Q3. Can I switch between the old and new tax regimes every year?

✔ Salaried individuals can switch between the old and new regimes every year.

✔ Business owners & professionals cannot switch back after choosing the new regime once.

FAQs on Tax Deductions & Exemptions

🔹 Q4. Can I claim Section 80C deductions under the new regime?

✔ No. The new tax regime does not allow deductions under 80C, 80D, or HRA.

🔹 Q5. Is the ₹50,000 standard deduction available in the new tax regime?

✔ Yes. The standard deduction of ₹50,000 is allowed for both salaried employees and pensioners.

🔹 Q6. Can I claim a home loan interest deduction in the new tax regime?

✔ No. The ₹2 lakh deduction on home loan interest (Section 24b) is only available in the old regime.

🔹 Q7. Is NPS tax-saving available under the new regime?

✔ Only employer contributions to NPS (Section 80CCD(2)) are tax-free under the new regime.

✔ Voluntary contributions (80CCD(1B)) are not allowed as a deduction.

🔹 Q8. What deductions are allowed under the new tax regime?

✔ Very few deductions are allowed, including:

✅ Standard Deduction (₹50,000)

✅ Employer NPS Contribution (80CCD(2))

✅ Agniveer Corpus Fund Deduction

FAQs on Tax Filing & Compliance

🔹 Q9. What is the due date for filing Income Tax Returns (ITR) in 2025?

✔ For salaried individuals & non-audit taxpayers: 31st July 2025

✔ For businesses requiring an audit: 31st October 2025

🔹 Q10. Do I need to file an ITR if my income is below ₹4 lakh?

✔ No, if total income is below ₹4 lakh, there is no tax liability.

✔ However, filing ITR is still recommended for:

✅ Claiming TDS refunds

✅ Applying for loans or visas

🔹 Q11. What happens if I file my ITR late?

✔ Late filing penalty:

✅ ₹5,000 if filed after the due date but before 31st December 2025

✅ ₹10,000 if filed after 31st December 2025

🔹 Q12. How can I check which tax regime is better for me?

✔ Use an income tax calculator to compare tax liability under both regimes before filing.

🔹 Q13. Can I revise my tax return after filing?

✔ Yes, ITR can be revised until 31st December 2025 if you made an error.

🔹 Q14. What is the minimum income required to file taxes in India?

✔ If your income exceeds ₹4 lakh (new regime) or ₹2.5 lakh (old regime), filing ITR is mandatory.

FAQs on Saving Tax Legally

🔹 Q15. How can I legally reduce my tax burden in 2025-26?

✔ If choosing the old regime, invest in:

✅ PPF, ELSS, LIC, NPS (80C deduction)

✅ Health insurance (80D deduction)

✅ Home loan interest deduction (Section 24b)

✔ If choosing the new regime, maximize:

✅ Standard deduction (₹50,000)

✅ Employer’s NPS contribution

✅ Salary structuring to get tax-free allowances

🔹 Q16. How can I save tax on my salary in 2025-26?

✔ If under the old regime, restructure your salary to include:

✅ House Rent Allowance (HRA)

✅ LTA (Leave Travel Allowance)

✅ Meal & travel reimbursements

✔ If under the new regime, request your employer for:

✅ Higher NPS contribution

✅ More tax-free allowances like mobile & internet reimbursements

FAQs for Senior Citizens & Pensioners

🔹 Q17. Is pension taxable under the new tax regime?

✔ Yes, pension is treated as salary income and taxed under normal slabs.

✔ ₹50,000 standard deduction is available for pensioners.

🔹 Q18. What tax benefits are available for senior citizens in 2025-26?

✔ For senior citizens (60+ years):

✅ Higher health insurance deduction (₹50,000 under 80D)

✅ No TDS on bank FD interest up to ₹50,000 (80TTB)

✔ For super senior citizens (80+ years):

✅ Exemption limit is ₹5 lakh in the old regime.