The PAN Card is more than just a piece of plastic; it’s an indispensable financial document for anyone in India engaging in economic or tax-related activities. Whether you’re an individual earning an income, a business managing finances, or an NRI dealing with property transactions, the PAN Card plays a critical role in ensuring compliance with India’s tax regulations.

This guide will walk you through everything you need to know about the PAN Card—what it is, why it’s important, how to apply, and much more. By the end of this article, you’ll have a clear understanding of why this card is a must-have and how to navigate processes related to it efficiently.

- What is a PAN Card?

- Key Features of a PAN Card:

- Why is a PAN Card Essential?

- Types of PAN Cards

- How to Apply for a PAN Card

- How to Check PAN Card Status

- Common Mistakes and How to Avoid Them

- How to Update or Correct PAN Card Details

- Consequences of Not Having or Misusing a PAN Card

- FAQs About PAN Cards

- PAN Card News & Updates

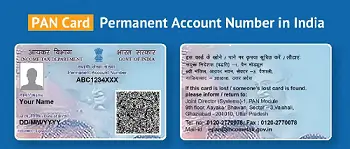

What is a PAN Card?

A PAN Card, short for Permanent Account Number, is a unique 10-character alphanumeric identifier issued by the Income Tax Department of India. It serves as a universal identification key for tracking financial transactions, ensuring that taxes are paid, and preventing tax evasion.

Key Features of a PAN Card:

- Unique Number: Each PAN is unique to the individual or entity it’s assigned to.

- Structure: The 10-character format includes letters and numbers (e.g., ABCDE1234F).

- Lifelong Validity: The PAN does not require renewal and remains valid for the holder’s lifetime.

- Governance: The Central Board of Direct Taxes (CBDT) oversees PAN issuance and compliance.

Why is a PAN Card Essential?

The PAN Card is not just a tax document; it’s a critical part of India’s financial ecosystem.

For Indian Citizens:

- Mandatory for Filing ITR:

- Required for individuals and businesses to file income tax returns.

- Essential for Major Financial Transactions:

- Opening a bank account.

- Buying or selling property.

- Investing in shares, mutual funds, or fixed deposits exceeding specified limits.

- Linking with Aadhaar:

- Mandatory for seamless integration of government services and compliance.

- Prevention of Tax Evasion:

- Links all taxable transactions, ensuring transparency.

For Non-Resident Indians (NRIs):

- Investments: Essential for investing in Indian markets.

- Property Transactions: Required when buying or selling immovable property in India.

- Banking Needs: Opening NRO/NRE accounts or making high-value transactions.

Types of PAN Cards

PAN Cards are issued to different categories of applicants. The type of PAN determines its usage:

- Individual: For salaried professionals, freelancers, and general citizens.

- Hindu Undivided Family (HUF): Specific to family businesses.

- Companies: Issued to registered businesses, private firms, and partnerships.

- Trusts and NGOs: For non-profit organizations.

- Foreign Entities: Special PANs for foreigners conducting business in India.

How to Apply for a PAN Card

Obtaining a PAN Card is straightforward, and the process can be completed online or offline.

Eligibility Criteria:

- Indian Citizens: Must provide proof of identity, address, and date of birth.

- NRIs: Required to submit additional documentation.

- Foreign Entities: Must submit proof of business registration in India.

Step-by-Step Application Process:

- Online Application:

- Visit the NSDL or UTIITSL portal.

- Fill out Form 49A (for individuals) or Form 49AA (for entities).

- Upload scanned copies of required documents.

- Pay the application fee (approx. ₹107 for Indian addresses, ₹994 for foreign addresses).

- Submit the form and note the acknowledgment number.

- Offline Application:

- Obtain Form 49A/49AA from authorized centers.

- Fill out and submit the form with photocopies of supporting documents.

Expected Timeline:

- PAN is usually issued within 15 working days of application submission.

How to Check PAN Card Status

Tracking the status of your PAN application is easy and can be done through multiple methods:

- Online Tracking:

- Visit the NSDL/UTIITSL website.

- Enter your acknowledgment number.

- View the real-time status of your application.

- Via SMS:

- Send an SMS to the specified helpline number with your acknowledgment details.

- Customer Support:

- Call the PAN helpline for status inquiries.

Common Mistakes and How to Avoid Them

Mistakes during the application process can cause delays or rejections. Avoid these common errors:

- Mismatched Details: Ensure that the name and address on your application match your supporting documents.

- Incorrect Form Submission: Use Form 49A for residents and Form 49AA for non-residents.

- Unlinked PAN and Aadhaar: Linking PAN with Aadhaar is mandatory to keep the PAN active.

How to Update or Correct PAN Card Details

Life changes like marriage or relocation may require updates to your PAN Card.

Reasons for Updates:

- Change in name after marriage or divorce.

- Correction of spelling errors.

- Updating address or contact information.

Process for Corrections:

- Online Method:

- Visit the NSDL/UTIITSL portal.

- Select the option to update or correct PAN details.

- Upload supporting documents.

- Pay the applicable fee (₹107 for Indian addresses).

- Offline Method:

- Submit a correction form at authorized centers with required documents.

Consequences of Not Having or Misusing a PAN Card

Failing to use or update your PAN Card can lead to significant penalties:

- Non-compliance Penalties: Fines up to ₹10,000 for not quoting PAN in mandatory transactions.

- Risk of Deactivation: PANs not linked to Aadhaar are declared invalid.

- Identity Theft: Protect your PAN details to avoid fraud or misuse.

FAQs About PAN Cards

Q. Can a person have multiple PAN Cards?

No, possessing more than one PAN is illegal and punishable.

Q. What happens if I lose my PAN Card?

You can apply for a duplicate PAN online or offline.

Q. Is PAN mandatory for minors?

Only if they engage in taxable financial activities.

Q. How to surrender duplicate or extra PAN Cards?

Submit a request online via the NSDL/UTIITSL portal or at an IT Department office.

PAN Card News & Updates

PAN 2.0 : A digital Leap in Tax payer Services

The Indian government has rolled out PAN Card 2.0 with enhanced security features, including QR-code-based instant authentication and digital integration to simplify financial transactions and KYC processes. Read More here: Pan Card 2.0