Aadhaar-PAN Linking Matters in 2025

The Government of India has made it mandatory to link your Aadhaar card with your Permanent Account Number (PAN) to simplify tax administration and eliminate duplicate PANs. This linking ensures transparency, prevents tax evasion, and streamlines the process of filing Income Tax Returns (ITR).

In 2025, the Income Tax Department continues to remind citizens to complete this linking before the official deadline. Failing to do so could lead to your PAN becoming inoperative, blocking your access to essential financial services.

- Aadhaar-PAN Linking Matters in 2025

- 📜Why Linking Aadhaar with PAN is Mandatory

- ⚠️ What Happens If You Don’t Link Aadhaar with PAN

- 💻 Step-by-Step Guide to Link Aadhaar with PAN Online

- 📱 How to Link Aadhaar with PAN Using SMS

- 🏢 How to Link Aadhaar with PAN Offline

- 💰 Fees and Penalty for Linking After Deadline

- 🔍 How to Check Aadhaar-PAN Link Status

- ⚙️ Common Errors and Solutions While Linking

- 🧾 How to Correct or Delink Aadhaar-PAN Details

- 🌍 Who is Exempted from Linking Aadhaar and PAN

- ✈️How NRIs and Foreign Citizens Can Link Aadhaar with PAN

- 🛡️ Safety Tips: Protecting Your Aadhaar & PAN Information

- ❓FAQs on Linking Aadhaar and PAN

- ✅ Final Thoughts

📜Why Linking Aadhaar with PAN is Mandatory

The linking of Aadhaar and PAN isn’t just a suggestion—it’s a government mandate under Section 139AA of the Income Tax Act, 1961.

Here’s why it’s so important:

- ✅ Avoid Duplicate PANs: Prevents people from having multiple PAN cards for tax evasion.

- ✅ Streamlines ITR Filing: Aadhaar-PAN linkage enables auto-verification of your ITR, reducing manual checks.

- ✅ Simplifies KYC: Helps in quick verification for banks, mutual funds, and Demat accounts.

- ✅ Reduces Fraud: Strengthens the government’s ability to trace fraudulent transactions.

The Central Board of Direct Taxes (CBDT) made Aadhaar-PAN linking mandatory for every taxpayer who holds both documents.

⚠️ What Happens If You Don’t Link Aadhaar with PAN

If you don’t link your Aadhaar and PAN by the due date, your PAN becomes inoperative, meaning it cannot be used for financial or tax-related activities.

Consequences:

- ❌ You can’t file Income Tax Returns (ITR).

- ❌ You can’t receive tax refunds.

- ❌ Higher TDS/TCS rates will apply on transactions.

- ❌ PAN cannot be used for banking, mutual funds, or property deals.

- ❌ Transactions requiring PAN will fail.

However, once you complete the linking process, your PAN becomes operative again within 30 days of successful verification.

💻 Step-by-Step Guide to Link Aadhaar with PAN Online

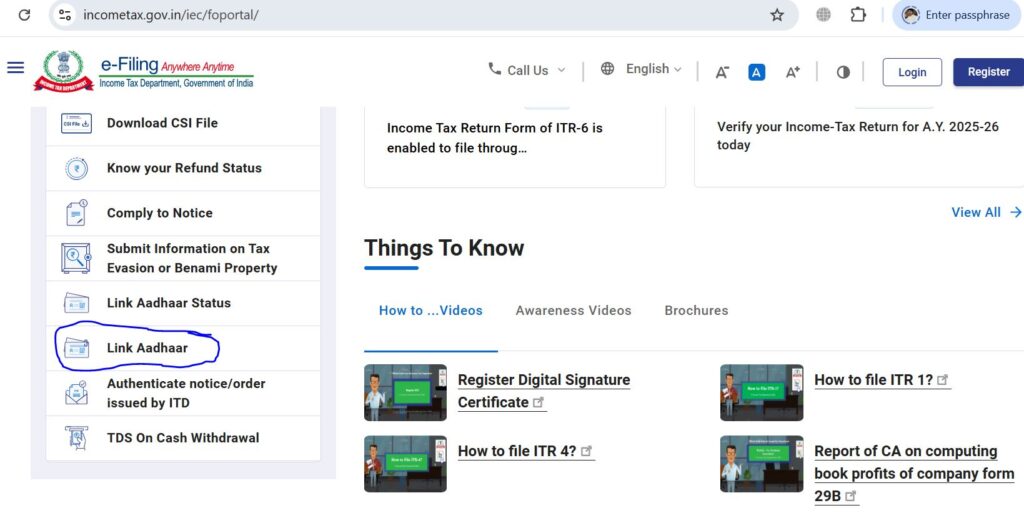

The easiest and most recommended method is through the Income Tax e-Filing portal. Here’s how you can link Aadhaar with PAN online in 2025.

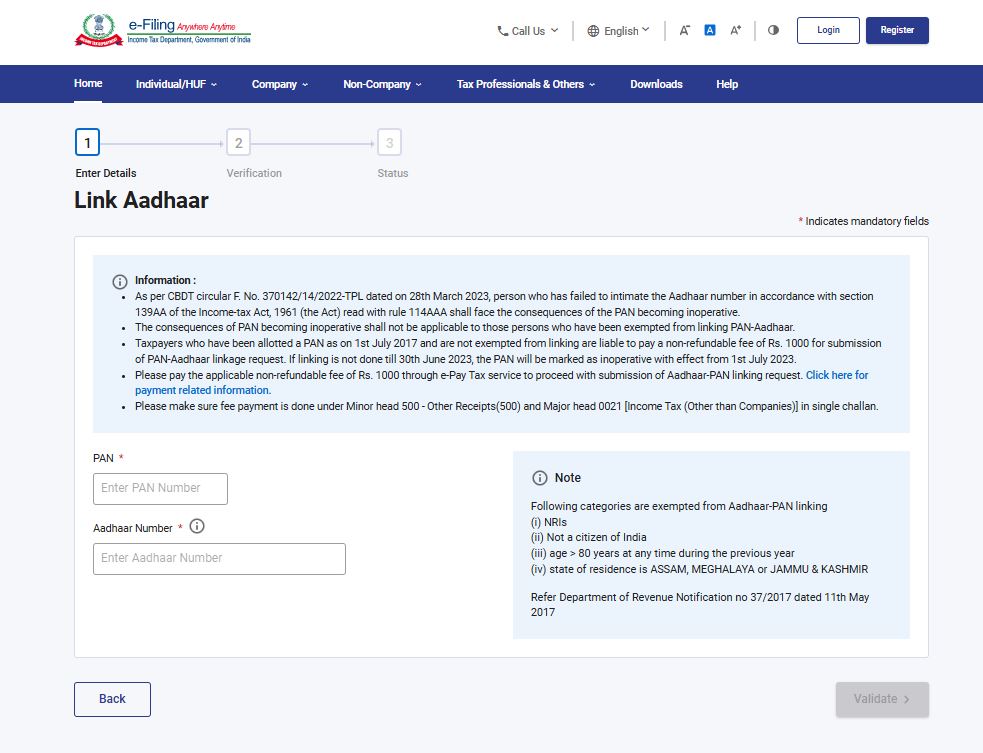

Step-by-Step Process:

- Visit the official portal:

Go to https://www.incometax.gov.in. - Find “Link Aadhaar” option:

Under Quick Links, click on ‘Link Aadhaar’.

- Enter your details:

- PAN

- Aadhaar Number

- Registered Mobile Number

- Check the details displayed:

Ensure your name, date of birth, and gender match on both cards. - Proceed to link:

Click on “Link Aadhaar”. - Payment (if applicable):

If not linked before, you’ll need to pay ₹1,000 penalty via ‘e-Pay Tax’. - Verify payment:

After successful payment, revisit the link page and confirm. - Confirmation message:

You’ll receive a message saying “Your Aadhaar is successfully linked with PAN.”

💡 Make sure your Aadhaar and PAN details match exactly. Even a small spelling difference can cause linking failure.

📱 How to Link Aadhaar with PAN Using SMS

If you prefer not to use the website, you can also link Aadhaar with PAN via SMS.

Follow These Steps:

- Open your mobile’s messaging app.

- Type the message in the format below:

UIDPAN<space><12-digit Aadhaar><space><10-digit PAN> - Send the SMS to 567678 or 56161.

Example:UIDPAN 123456789012 ABCDE1234F

You’ll receive a confirmation message from the Income Tax Department once the linking is successful.

📞 Ensure your Aadhaar-registered mobile number is active to receive OTP and confirmation.

🏢 How to Link Aadhaar with PAN Offline

For individuals without internet access or facing technical issues, Aadhaar-PAN linking can also be done offline.

Here’s How:

- Visit your nearest PAN service center (NSDL or UTIITSL).

- Fill out the Aadhaar-PAN Linking Form.

- Attach:

- Self-attested copy of your Aadhaar card

- Self-attested copy of your PAN card

- Pay a nominal service fee (usually ₹50–₹100).

- Submit and collect your acknowledgment slip.

The linking usually takes 7–10 working days to reflect in the Income Tax database.

💰 Fees and Penalty for Linking After Deadline

If you missed the previous deadlines, you can still link Aadhaar and PAN, but a penalty of ₹1,000 applies.

Payment Method:

- Visit https://www.incometax.gov.in.

- Select ‘e-Pay Tax’ → Proceed → Link Aadhaar’.

- Pay ₹1,000 via:

- Net Banking

- Debit Card

- UPI

- Pay at Bank Counter (if supported)

Summary Table:

| Scenario | Fee | PAN Status |

|---|---|---|

| Before Deadline | ₹0 | Active |

| After Deadline | ₹1,000 | Active after payment |

| Not Linked | – | Inoperative |

⚠️ Penalty must be paid before attempting to link. Otherwise, the process will fail.

🔍 How to Check Aadhaar-PAN Link Status

After linking, it’s good practice to confirm the status.

Check via Income Tax Portal:

- Visit https://www.incometax.gov.in.

- Click on ‘Link Aadhaar Status’.

- Enter your PAN and Aadhaar number.

- Click on ‘View Link Aadhaar Status’.

You’ll see one of the following:

- ✅ Your PAN is linked with Aadhaar

- ⚠️ PAN-Aadhaar linking request is in process

- ❌ Your PAN is not linked with Aadhaar

⚙️ Common Errors and Solutions While Linking

While linking, users often face issues due to mismatched or incorrect data.

Common Errors:

- Name mismatch between PAN and Aadhaar

- Incorrect date of birth

- Unpaid penalty not updated

- Aadhaar OTP not received

- Server timeout or validation error

How to Fix Them:

- Visit UIDAI Portal to correct Aadhaar details.

- Use NSDL Portal for PAN correction.

- Wait 48 hours after paying the penalty before retrying.

- Double-check your registered mobile and email for OTP.

🧾 How to Correct or Delink Aadhaar-PAN Details

If your Aadhaar or PAN details don’t match, the linking will fail. Here’s how to fix it.

Steps to Correct Details:

- Identify which document has the error.

- For Aadhaar update:

Visit https://myaadhaar.uidai.gov.in → Update Aadhaar Details. - For PAN correction:

Visit https://www.tin-nsdl.com → PAN Correction. - Once updates are approved, retry linking after 2–3 working days.

💡 There is no “delinking” feature currently. Once linked, it stays linked unless updated or corrected.

🌍 Who is Exempted from Linking Aadhaar and PAN

Certain individuals and categories are exempted from this requirement.

| Category | Exempted | Reason |

|---|---|---|

| Residents of Assam, J&K, Meghalaya | ✅ | Low Aadhaar coverage |

| Non-resident Indians (NRIs) | ✅ | Not required under Section 139AA |

| Individuals aged 80+ years | ✅ | Age-based exemption |

| Foreign nationals | ✅ | Not eligible for Aadhaar |

So, if you fall under these categories, you don’t need to link Aadhaar with PAN.

✈️How NRIs and Foreign Citizens Can Link Aadhaar with PAN

NRIs are generally not required to link Aadhaar with PAN unless they hold an Aadhaar number issued during extended stay in India.

Important Points:

- NRIs with an Aadhaar card can voluntarily link it to PAN.

- Those without Aadhaar can skip linking—no penalty applies.

- Foreign citizens with PAN but no Aadhaar are also exempt.

Always confirm your residential status under the Income Tax Act before proceeding.

🛡️ Safety Tips: Protecting Your Aadhaar & PAN Information

Since both Aadhaar and PAN contain sensitive personal data, ensure you handle them securely.

Security Tips:

- Always use the official Income Tax or UIDAI portals.

- Avoid third-party or unofficial sites promising “quick linking.”

- Never share OTPs or Aadhaar details over calls or messages.

- Use private internet connections (not public Wi-Fi).

- Look for “🔒 HTTPS” in the browser before making payments.

❓FAQs on Linking Aadhaar and PAN

Q1. What is the last date to link Aadhaar with PAN in 2025?

👉 The expected deadline is March 31, 2025, unless extended by the government.

Q2. How much is the penalty for linking after the deadline?

👉 ₹1,000 as per the latest CBDT rules.

Q3. Can I link Aadhaar and PAN without paying the penalty?

👉 No. If you missed the earlier deadline, you must pay the fine first.

Q4. How long does it take for the linking to reflect?

👉 Usually within 7–10 days of submission.

Q5. Can NRIs link Aadhaar and PAN?

👉 Only if they hold both documents; otherwise, they are exempt.

Q6. What happens if I don’t link my PAN and Aadhaar?

👉 Your PAN becomes inoperative, and you cannot file ITR or make high-value financial transactions.

✅ Final Thoughts

Linking your Aadhaar with PAN is a simple but essential compliance step for every taxpayer in India. With the online and SMS options available, the process barely takes a few minutes.

Don’t wait for the last date — complete your Aadhaar-PAN linking now to ensure your PAN remains active and your tax transactions remain seamless.

🌐 Do it today: https://www.incometax.gov.in